How to make a Loan App and Website?

Complete information about Loan App and Website? How much does it cost to make a Loan App and Website? Loan App and Website Earning and development cost? a complete guide of Loan App and Website development. make your own Loan App and Website.

The Road to Successful Loan App and Website Development

The financial industry has welcomed technology to offer innovative solutions to customers. The development of loan apps and websites has revolutionized the way people access financial services.

In this digital world, with just a few taps on their smartphones or a few clicks on their computers, individuals can apply for loans, check their eligibility, and manage their finances conveniently. If you're looking to venture into the world of loan app and website development, this blog will guide you through the key steps and considerations to ensure your success in this competitive market.

Business Model of Loan App & Website

- Customer Acquisition: Acquiring a user base is crucial. This can be done through various means such as digital marketing, partnerships, and referrals. Offering incentives like referral bonuses or first-time user discounts can help attract borrowers.

- Lending Products: Offer a range of lending products, such as personal loans, business loans, student loans, or payday loans.

- Underwriting and Risk Assessment: Implement a strong underwriting and risk assessment process to evaluate the creditworthiness of borrowers. This may involve analyzing credit scores, income, employment history, and other relevant factors. Use advanced algorithms and data analytics to automate this process efficiently.

- Interest and Fees: Generate revenue through interest rates and fees charged on loans. The interest rate charged should reflect the risk associated with the borrower. Ensure transparency in displaying the total cost of borrowing.

- Funding Sources: Secure funding to provide the loans. This can come from various sources, including private investors, banks, or lending platforms.

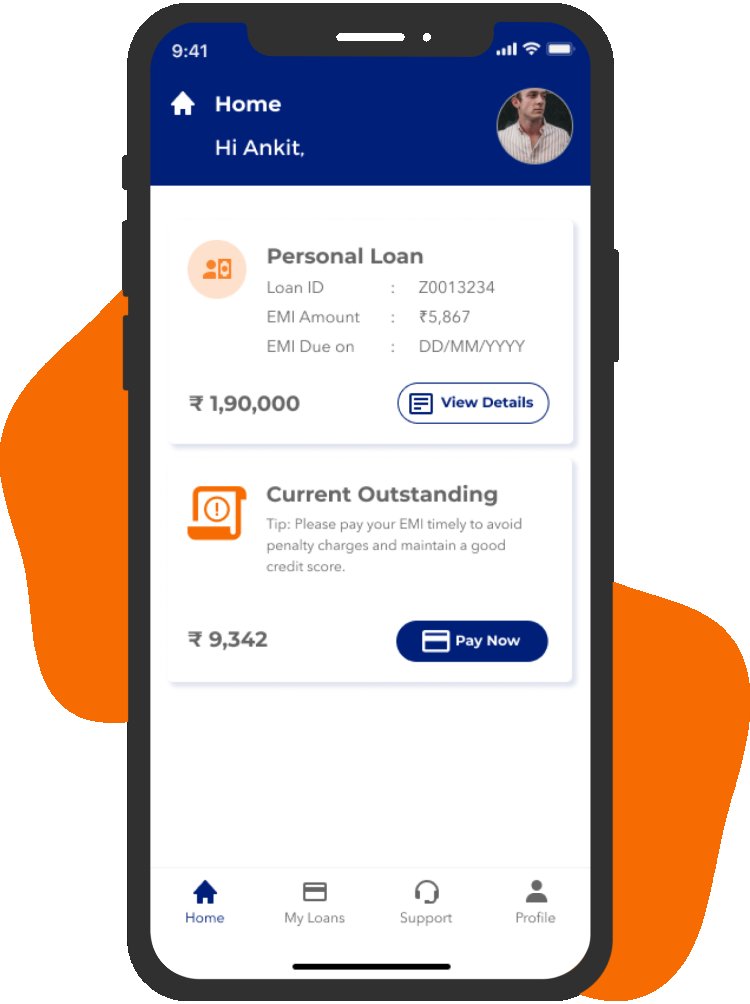

- Technology Platform: Develop and maintain a user-friendly and secure platform both app and website that allows users to apply for loans, check their status, make payments, and access customer support. Ensure that the platform is mobile-responsive.

- Regulatory Compliance: Stick to the legal and regulatory requirements in the regions where you operate. Compliance with lending laws, data protection regulations, and consumer protection laws is crucial.

- Customer Support: Offer responsive customer support to assist borrowers with any inquiries, issues, or concerns they may have during the loan application or repayment process.

- Credit Reporting: Report borrower payment information to the credit desk to help users build or rebuild their credit history, which can be a competitive advantage for your platform.

- Marketing and Promotion: Continuously market your platform to attract new borrowers and maintain brand awareness. This may include SEO, social media marketing, email marketing, and content marketing.

- Risk Management: Implement risk management strategies to minimize defaults and losses. This can include diversifying your loan portfolio and closely monitoring delinquent accounts.

- Data Security: Ensure the security of user data. This is not only critical for legal compliance but also for building trust with your users.

- Loan Servicing: Manage loan servicing tasks such as collecting payments, processing loan renewals, and dealing with late payments.

- Scalability: Design your platform and operations to scale as your user base grows. This may involve expanding your product offerings, entering new markets, or developing partnerships.

- Revenue Sharing or Commission: If you partner with other lenders or financial institutions, you may earn commissions or fees for referring customers to them.

- User Feedback and Improvement: Regularly gather feedback from users to improve your platform and the user experience.

- Exit Strategy: Consider long-term goals and potential exit strategies, such as an IPO, acquisition, or expansion into other financial services.

Loan App in India and their Development Cost

There are many popular Loan Apps and Websites in India, some of them are PaySense, Aditya Birla Capital, IndusInd Bank, Aditya Birla Personal Finance, Tata Capital, Moneyview, Bajaj Finserv, KreditBee, mPokket, and many more. Cost of developing these types of clone apps is basically Rs 2-2.5 lakhs with basic features and functionalities, but it totally depends on your needs. Cost will increase with the increase in complexity of the app. For developing Loan clone apps explore meratemplate.com.

How to avoid loan app scams?

- Research the lender: Before downloading any loan app, conduct thorough research on the company or individual offering the loan. Check for legal contact information, a physical address, and online reviews to ensure their credibility.

- Verify licenses and certifications: Ensure that the lender is licensed to operate in your area and complies with all necessary regulations. Scammers often lack these credentials.

- Beware of unrealistic promises: Be cautious of loan offers that seem too good to be true.

- Protect your personal information: Only share your personal and financial details with reputable lenders. Legitimate lenders will use secure channels to collect this information.

- Avoid upfront fees: Legitimate lenders do not request upfront fees or advance payments before providing a loan. Refrain from sending money to secure a loan, as scammers commonly exploit this tactic.

- Check the app's permissions: Review the permissions the loan app requests upon installation. If an app asks for excessive access to your personal data, it could be a red flag.

- Read the fine print: Carefully read and understand the terms and conditions of the loan, including interest rates, repayment schedules, and any hidden fees.

- Seek professional advice: If you're unsure about the legitimacy of a loan app or offer, consult with a financial advisor or attorney for guidance.

Advanced Features and Tools

- Credit scoring algorithms: Implement AI-driven credit scoring to assess an applicant's creditworthiness accurately.

- E-signature integration: Allow users to sign loan agreements digitally for added convenience.

- Payment calculators: Provide users with tools to estimate their monthly payments and loan term.

- Real-time notifications: Keep users informed about their loan status, payment due dates, and other important updates.Secure document uploads: Enable users to submit required documents securely.

Earnings in Loan App and Website Development

Earnings in the loan app and website development industry can vary significantly based on factors such as project size, complexity, and location. Developers and companies can generate revenue through client fees, app purchases, advertising, or subscription models. Success in this industry depends on offering innovative solutions and meeting the specific needs of the target audience.

In conclusion, developing a loan app and website is a significant undertaking, but it can be highly rewarding in the fintech sector. By understanding the market, defining your niche, complying with regulations, designing a user-centric interface, and prioritizing security, you can create a platform that stands out from the competition. With advanced features and effective marketing, you'll be on the path to success in the world of loan app and website development. Remember, the key to success is delivering a valuable and trustworthy service to your users.

------------------------------------------------------------------------------------

- Contact us: 8888647482

- Email id: sunil@meratemplate.com

- Telegram - https://t.me/sunilyadavtutorial

- Youtube - https://www.youtube.com/c/MeraTemplate

Thank you so much for taking the time to read my article.

Mera Template

Mera Template